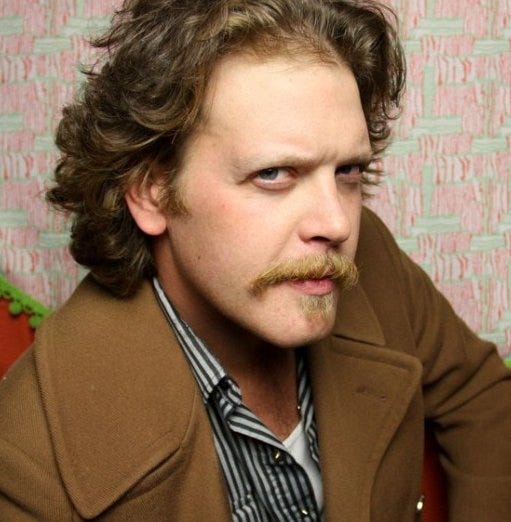

A New Economic – Interview with Garret Tufte

Interview - 13 minute read

A land surveyor by trade, Minnesota transplant Garret Tufte found an interest in economics and history early on in life. In college, he attended lectures on economics while pursuing a degree in English Creative Writing at KU in 2008. From there, the political and economic world took hold of his interest even more and he began to question the way out of the current situation Americans found themselves in.

“The economic and political world was increasingly stifling,” Tufte said. “It was baffling to me the sort of policies that would be put in place by those ostensibly put in charge.”

Seeing a class-tension, Tufte began thinking of a way to turn things around in America, not just for “regular people” but everyone else who’s involved in the system.

It was in 2009 that Tufte began developing what he would call ‘A New Economic’ a “simple, three-step approach” that he claims could recreate the American Empire, liberate the People of the U.S. (and the World), pre-empt economic collapse, drastically reduce energy consumption, free the human spirit, create the greatest society in written history, lead the world into the 21st century, and more. He has broken his ideas for what he calls, “The Great Awakening,” into parts, with at least three parts total. In an interview with Tufte, we discussed part one which goes over his three-step plan to economic freedom. His ideas seem to mix Ayn Randian philosophy with ideas of socialism to create a brand-new economic system. This intriguing combination of polar opposite ideals is something Tufte claims would give everyone in America the realistic option to become a homeowner at minimum.

“This plan was basically in the works as a sort of seed in the back of my mind,” Tufte said. “There’s got to be some sort of magic bullet here. There’s got to be a way to transform our economy into something that works for everyone. [Something] that has a great benefit that hasn’t been come up with yet. So, I figured I would dedicate my abilities—creative abilities, intellectual capacity to go toward that front.”

Step 1: Properties

Anyone who legally occupies a residence, may opt to own it. Repeat for other properties utilized by the person or family: cars, land, equipment, the building in which a business is located, etc.

In a pamphlet on part one, Tufte notes on the process that “it may be most efficient to process leases and deeds at the local level and put the appraised monetary value into a new account at the time of ownership transfer.” He also wrote in regard to application of step one that “these propositions may be undertaken by any nation-state, or group that would benefit from such an economic revolution that wants to clean up its finances, a ‘declaration of monetary independence,’ while maintaining property value and relative economic position of its citizens.”

“They call it eminent domain,” Tufte explained. “Say, for instance, they put in a levee here by the river. The state, also the feds, whoever else is involved with it. They would have to take private land in order to build it out properly. So, what do you get for that private land? The fifth amendment—that’s basically items to be seized. If they are to be seized there needs to be appropriate recompense. You need to be paid for it…. So, that’s the legal principal that’s applicable to it.

“…If and when this gets implemented, you’re going to have a lot of people on a case-by-case basis that are going to say, ‘Oh well, no, actually, the house is worth x-dollars more than what you’re asking me for.’ There’s going to be some arbitration involved in just about everything whenever somebody raises an issue about it. That can be mitigated a little bit, too, by the fact that someone is asking for more, that additional actually reduces the value of the currency when it’s implemented.

“…Let’s just say the metric is $100 per square foot, you’re asking for more than that, ‘I expect $150, or something,’ what you are going to do is dilute the currency that gets paid out to the person who receives that payout. So, you apply that to the entirety of the transformation, and what you end up finding is that it doesn’t really matter what the initial value of it is just so long as that value is consistent across the board. After that, you can tie the value back to the properties themselves—square footage or acreage or something like that can be a metric by which it adheres, similar to the gold standard where dollars are worth x-amounts of gold.”

When questioned about the rights of property investors, who would have to give up their property to any occupants who choose to opt in to own the property, investors would receive the payout for the property. When questioned about government intervention if the owner did not want to give up their property, Tufte explained, “Getting fined would be nonsensical because whatever fine that would be issued to them would not be applicable because the present currency won’t be used for the most part. The U.S. dollar isn’t going to go away exactly, but what’s going to happen is there’s going to be a transference of usage to where they’ll quit using the dollar, but they use this particularly for real estate transactions. Then, over the course of some amount of time—might be fast, might be slow, I don’t know—we move further and further into using the new currency exclusively. Now, in order for this to work, sorry to say, but yeah, whoever is living there, whoever is at that house, it is the residence, they need to be able to live there and own it. That’s the major thing that is driving people to have to work in jobs they don’t like—jobs they hate that actively goes against their own benefit or the benefit of the American people. They’re working a lot of jobs that simply don’t need to be there at all. They’ve been made, built up, and bloated—entire economic sectors—look at the healthcare industry, look at the education industry where they have just bloat of endless administration that is just a waste of everyone’s time. There is no reason for people to have to do this except they have to get a paycheck somehow from our tax dollars to pay them to do nothing beneficial for anyone but themselves. The way that you get people out of that—they have to be free of the rent and the mortgage payments that force people to go out and do things they don’t actually want to do. It, also, gives them the room to start their own businesses and that’s the huge thing that would be coming up. The idea is to take this system that we have and transform it in such a way that we have that new Renaissance. When you take… 65 percent of the population right now that is working paycheck to paycheck… suddenly, that drops to zero, what you have is people for the first time in their lives being able to do what they want with their time.”

Tufte explained there are one of two options for when it comes to our currency. The first being a solid, static amount of money adherent to gold, the second by taking a percentage of inflation as the size of the government and reinstating a new currency every few generations. “Which one’s better? I don’t know. We’ve done the fiat thing for long enough, so probably just good to go away from that. Then, you might want to go to something like what was done prior when we [were on the gold standard], then we switched it out back in 1971. Those appear to be two solid camps when it comes to economics. That’s operable economics. That’s economics of process…. This plan is how you create an economy as opposed to how you run an economy. So, those two options are how you run the economy after.”

Step 2: Accounts

Debts, foreign and domestic, are forgiven, and subject accounts in USD, e.g., are used to pay foreign debts.

Tufte notes that this step is optional and due to the Constitution, unlikely to be carried out in the U.S. As stated in his pamphlet, “In the United States, the practical implementation of this transformation is dependent upon the Constitutional frame, particularly the Fifth Amendment.”

“If you wanted to maintain the new currency as a fiat currency, you get rid of the income tax and you basically get rid of every federal tax there is, and you can have the new reinstituted federal reserve print out money just to pay for the federal government. Wherein, by doing so, the federal government as a percent of GDP would be the inflation rate itself. So, if the federal government made up 1.5 percent GDP and that amount of money which is needed to fund the government is printed out for the express purposes of doing so, you would have a government of that size and you would have an inflation of that amount each year.”

Tufte explained that by doing this a reset of the economic system would be necessary multiple generations down the road. Thus, a new currency, once again, would be reinstituted, benefitting everyone, rich and poor.

“The second step is an encouragement to stop using the U.S. Dollar,” Tufte said. “Sending out and paying foreign debts that we have contracts in can be paid in U.S. Dollars. That’s a good place in which to pay them. Like I said, the U.S. dollar is not going to be going away, it’s still going to be used for buying and selling all sorts of things. But eventually what’s going to happen is the preponderance of it is just going to inflate and inflate and inflate the less people use it. So, eventually, its utility to that is going to go out the top and the country is going to stop using it.”

Tufte pointed out that this optional step could be used in any city, county, state, or country, calling it an “economic declaration of independence.”

“This would work for secession as well,” Tufte said. “Any country or any portion of a country that wants to break away from a larger, over-bloated centralized government that doesn’t want them nipping at their heels anymore, the most important way to do that is to stop using their money.”

Looking at the Biden Administration’s recent student loan forgiveness which hurts taxpayers who did not go to college in favor of people who did and will therefore most likely make more money, I raised concerns of how this step could possibly hurt the poor.

“If you’re closing those accounts, in a way, what you’re doing is taking that away from the person,” Tufte explained. “So, you can’t do that without some sort of recompense. I’ve actually thought about pulling [step two] out entirely from this plan, but I thought it’s helpful to have it in there as a kind of guide because the idea is to get away from the U.S. dollar. And the debt forgiveness thing—I’ve gone through all the, what you might say, ‘progressive’ efforts of fixing the wealth and equalities we have, none of them work. Somebody gets screwed hard always in some way, and you have the same thing with the debt forgiveness…. There are losers in all those situations. In this one, there’s as few losers as you can possibly get. Everybody wins. Some people might win a little bit more. Some might win less. But everybody wins…. Whether you’re a renter. Whether you’re someone who had a mortgage and paid it off. Someone who just got a mortgage on your house, you still win. If you’re the bank that put out the mortgage, you win. If you’re the government itself, you win because there’s a whole bunch of garbage you can just throw away… for various reasons. All the bloat and the convoluted nature of everything—tax system and all that—can be thrown away because it’s just obsolete—not needed. If you’re a business, you benefit from this—the real estate that you’re at, your taxes pretty much go away. Again, everybody wins…. There are going to be some people who aren’t happy, I guess, but this is the best revolution you can get. Some slight changes might be beneficial that could make it better, and I’m interested in that.”

Step 3: Reconciliation

In a new, tangible currency, former owners are paid the appraised value of each property transferred in Step 1.

In the third and final step, Tufte writes in his pamphlet qualifications for this step: “If a person or family owns their own home outright, and resides there, they receive full appraised value in the new currency. Mortgagers receive the value of which they had previously paid. The bank receives the remainder. Pensions can be similarly transformed.”

He further states that “this plan forever reconciles and transcends capitalism and communism, the most destructive ideological schism of the last 200 plus years.”

“You can’t just give ownership to everybody,” Tufte explains. “You have to give some sort of recompense for those who no longer own the thing. That’s where [step three] comes in. That’s where it connects. That’s where the circle completes, you might say.

“…I say, ‘appraised value,’ I should say, ‘appraised at consistent,’ so there has to be a consistency, and the actual amount is open to fluctuation. When you actually institute this, you do it all at once, and then you find out what the value is after that. Then, the exchange rates and everything will come after that. If it turns out you get ten new dollars for each square foot, or you get 20 new dollars for each square foot—either way, the square footage is what makes the value of that new currency.”

He further notes that these propositions don’t need to be done suddenly, suggesting somethings may need to be done gradually or “behind the scenes.”

“If you were to look at what would happen to the world without some sort of massaging… any president that were to say, ‘Hey, this is what we’re going to do,’ A, they probably won’t be able to answer many questions that come after it, unless they have me telling them how it works. B, let’s say the ‘chaos’ that it would throw the market into would be pretty astronomical. It would be pretty crazy. It’s the sort of thing that you kind of need to set things up prior behind the scenes before you release publicly that it’s to be done. I think in some cases that’s kind of been going on. Whether it’s intentional or not, I don’t know, because the sorts of things that have been going on as a result of the virus panic on a manufacturing and industrial sort of level, but they were also sort of trending that way as a result of Trump’s trade policies. Namely putting tariffs on China and getting manufacturing back here in the United States. That’s pretty important in order for this to go through because you’re going to have the international supply chain that is going to be messed up greatly just because of exchange rates and that sort of thing are going to be thrown into all sorts of madness and chaos. This is also what you might call an ‘America first’ idea as well, because it really does require that you have manufacturing and industrial bases in your own country when you implement this so you have access to all the things you need to live your life. Water, electricity, all those sorts of things, because you need to be able to pay for those things, but if you don’t have the right currency to pay for them, then you can’t make the transaction.”

The system is meant to work when people are self-sufficient at a community level, Tufte pointed out.

He explains in his pamphlet that you need to ask yourself one question, “Would this benefit me?” According to him, “This plan asks only that you, and us all, be selfish. Everyone wins, regardless of class, race, religion or sex. Have you ever wanted to follow your passion, but worried that you would lose your job, your apartment, or your house? The goal of this plan is for you to own your apartment, to own your house, to own your car, to own your business, and to be free of any and all kinds of debt. To help make this happen, spread the word, and it will.”

To checkout Tufte’s website, click here.

To contact Tufte, you can email him at gtufte13@gmail.com