Governor Kelly v. Austin: The Kansas tax dilemma

Article/Taxes - 6 minute read

Democrat Governor Laura Kelly has spoken extensively about cutting taxes and her work to boost the economy.

Kansas news sources like WIBW have quoted Governor Kelly, saying things like, “Taxes on groceries and other basic necessities exacerbate income inequality because lower-income Kansans spend a higher share of their income on those taxes than wealthier Kansans. By Axing the Tax on basics, we’ll put money back in the pockets of Kansans who need it most.”

KSNF quoted Governor Kelly, saying, “My budget reflects my plan to responsibly cut taxes, continue growing our economy, fully fund education, and strengthen our infrastructure and workforce. We’re building a better Kansas for working families and retirees—all while maintaining a balanced budget.”

On top of what Kansas media is reporting on, her administration has been releasing press releases with some arguably interesting quotes by the Kansas governor as well as claiming to save Kansans millions of tax dollars. However, we should wonder about how accurate these statements and claims truly are.

Just from January 2023 alone, press releases from the government have made the following claims:

Governor Laura Kelly’s ‘Axing Your Taxes’ plan will “save Kansans more than $500 million in tax cuts over the next three years.” The “plan includes a push to immediately ‘axe the tax’ on groceries and eliminate the state sales tax on diapers and feminine hygiene products; create an annual sales tax holiday for schools supplies; and cut taxes on social security for retirees.” (January 4, 2023)

Governor Kelly’s Fiscal Year 2024 budget is “balanced”, “responsibly cuts taxes”, and “fully funds schools”. The budget includes, but is not limited to:

‘Axing Your Taxes’ a plan to cut $500 million in taxes over the next three years;

Investing nearly $110 million in higher education;

Putting $500 million in the Rainy Day Fund;

Keeping the ‘Bank of KDOT’ closed for a second year in a row and adding $220 million to Kansas’ “Infrastructure Leveraging Fund”;

Paying off the remaining $53 million for reservoir debts at Milford and Perry Lakes to save taxpayers nearly $30 million in future interest payments;

Paying in cash for the state’s share of the proposed new veterans home in Topeka, saving nearly $10 million in interest;

Invest over $5 million to increase placement rates for foster homes and support foster kids transitioning to adulthood;

Provide over $12 million to the current KanCare program;

Kansas will receive an estimated $370-$450 million in additional federal funding over the next two years when we expand Medicaid;

Increase state employee pay by 5 percent;

Provide $20 million to the Housing Revolving Loan Program to expand housing stock across the state;

To see the Governor’s full budget plan, click here; (January 12, 2023)

Governor Kelly announced $45 million to connect Kansans to high-speed internet; (January 18, 2023)

Governor Kelly announced nearly $1.8 million in funding for 10 family resource centers (January 25, 2023)

Whether you’re for all of these things or not, these aren’t things that are free. “Government funding” is taxpayer funding—this is money coming from the pockets of everyday Kansans. Ignoring all the tax cuts that Governor Kelly vetoed prior to the 2022 election year, the ‘Axing Your Taxes’ plan is supposed to save Kansans $500 million over the next three years. That’s significantly less than $200 million a year. However, according to her Fiscal Year budget for 2024, she plans to put $500 million into the Rainy Day Fund. For those who aren’t aware, Rainy Day Funds are in most states. In fact, in August 2020, it was shown that Kansas and Illinois were the only states without a Rainy Day Fund. According to the CATO Institute, “Large rainy day funds make states less reliant on federal bailouts, improve state credit ratings, and they strengthen the overall U.S. macroeconomy.” You can basically think of them as a sort of government savings account. So, the state government taxes Kansans an extra $500 million to put into this account to use so that Kansas—as the government press release put it—“is in a much better position to weather future storms”. However, we also need to ask what a “future storm” looks like. We don’t actually know. The past couple of years apparently didn’t constitute a “storm” because the Rainy Day Fund never got used. In fact, during Governor Kelly’s first four years as governor, when the pandemic was going on, Kansans were taxed a surplus of $1 billion that went to this Rainy Day Fund that has yet to be used for anything.

Furthermore, while states with large Rainy Day Funds may be less reliant on federal bailouts, the reality is people in Wyoming, the state with the largest Rainy Day Fund, received stimulus checks, too. Even with a Rainy Day Fund, the average state has less than a month of expenses saved up. Not only this, but Wyoming, along with five other states, have no specific conditions for withdrawing money. Wyoming even looked to use their Rainy Day Fund in the stock market back in 2018.

With all this being said, Kansas Economist Michael Austin has also been looking into Kansas’ tax situation and has discovered some arguably interesting things.

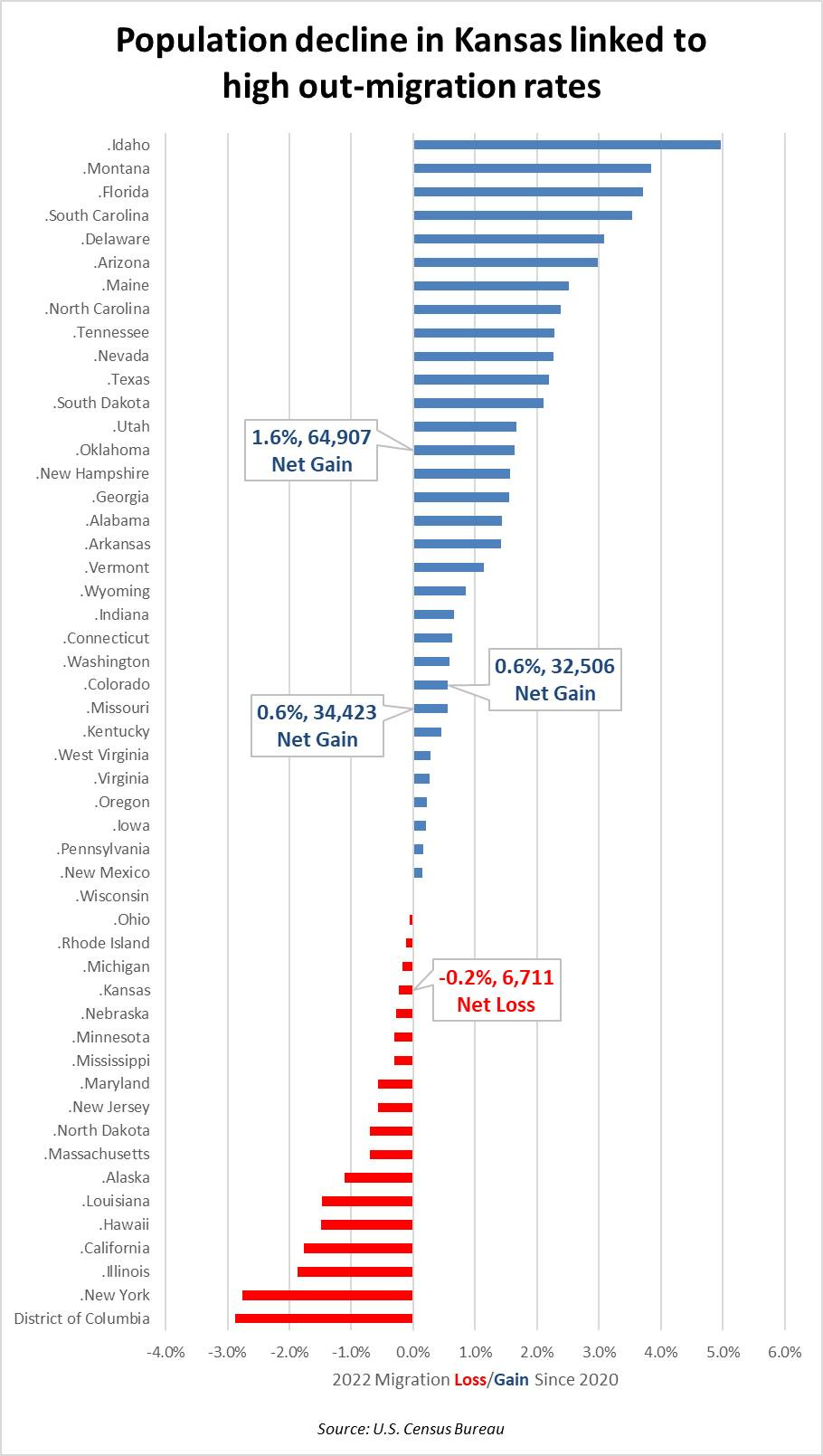

Again, just looking at the past month, we have found that Kansas has had a net loss of nearly 7,000 people from 2020 to 2022—one of only 14 states to experience this. The population decline is linked to high out-migration rates, and Austin is blaming Governor Kelly for her policies, stating in a Facebook post, “Similar patterns emerge in Illinois and New York, with woke governors with policies similar to Governor Kelly’s.”

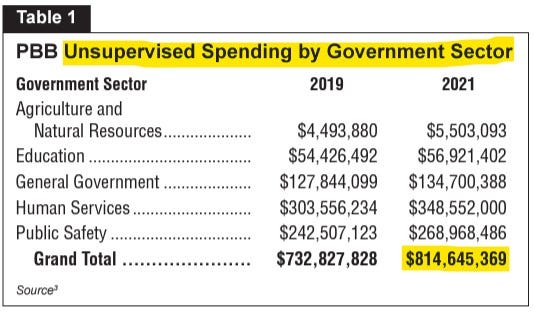

Furthermore, Austin did a budget review and he, along with the Kansas Policy Institute, found that $815 million was spent in fiscal year 2021 by Governor Laura Kelly on “state programs with deteriorating goals/outcomes.” A total of 132 state programs were found to have “declining outcomes” with 65 of those programs not reporting any performance measures despite receiving state taxpayer funds.

Austin broke this down further in a Facebook post revealing that he and the Kansas Policy Institute asked the question, “Which state programs failed to accomplish their stated goals yet saw an increase in taxpayer funding?”

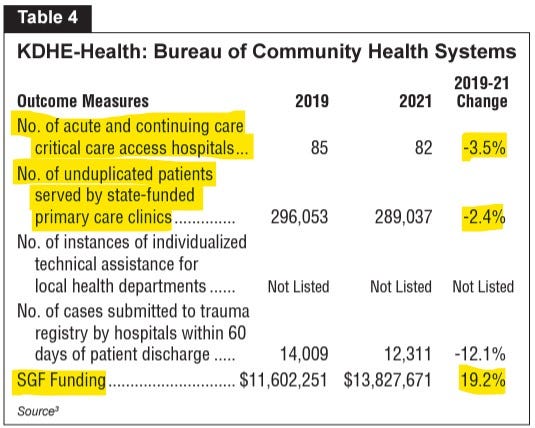

They found that “Human Services” agencies were responsibly for the most wasteful spending at $350 million. Austin cited KDHE’s Bureau of Community Health Systems for failing to meet both benchmarks the program defined to show its success. These benchmarks include increasing critical care hospitals and seeing more patients in state-funded clinics. Nevertheless, state taxpayer funding for the program increased by 19.2 percent.

He later posted, stating that the budget review is bipartisan as it’s the Democrat principle to give more funding to successful programs, and the Republican principle to re-evaluate failing programs and redirect the funds to more successful programs.

Going back to Governor Kelly’s budget that she revealed earlier this month, Austin had some things to say about it as well,

“The Kansas budget surplus is likely a result of the Federal Reserve pumping money into the economy to combat COVID costs. While this surplus exists, it is unwise to make long-term commitments, such as expanding Medicaid or increasing government funding for schools and colleges. The surplus will likely end as the Fed pulls back and inflation subsides.

“Moreover, this budget as a whole means Laura Kelly just shot a hole in any hopes for lower overall tax rates. Her sales tax shenanigans will make it harder to lower the near 12% rate in some parts of Kansas and flatten the income tax.”

With Governor Kelly’s budgeting plans to come, the issue of rising taxes in Kansas will continue to be a topic of interest for many Kansas taxpayers moving forward.