Taxes too high: Republican candidate fights Democrat-ruled government at city and county level

Article - 6 minute read

Republican Candidate for Douglas County District 1 Dr. Justin Spiehs is known to use his voice at city and county commissioner meetings as a sort of platform to get his campaign out there to the locals.

At the Lawrence City Commission meeting held on Tuesday, September 13, Dr. Spiehs spoke on the issues of taxation in Lawrence and the County as a whole.

“I know a lot of you might be turned off by the idea that I’m a Republican,” Dr. Spiehs said. “You might not vote for me, but I just want to bring some stuff to your attention, Lawrence. Over the last couple of weeks, the city commission, the county commission and last night the schoolboard all voted unanimously to raise your property taxes and the city commission here voted to increase your utility bills.”

Dr. Spiehs went on to point out those on the city commission were made up mostly of Democrats. These commissioners include Bart Littlejohn, Lisa Larson, Courtney Shipley, and Amber Sellers. Dr. Spiehs also accused Brad Finkeldei, the sole Republican city commissioner, to be a RINO (Republican in name only) as Finkeldei still voted to raise taxes. He then mentioned the schoolboard for USD 497 which is made up entirely of Democrats including Carol Cadue-Blackwood, Kay Emerson, Erica Hill, Kelly Jones, Shannon Kimball, GR Gordon-Ross, and Paula Smith. He further mentioned the county commissioners who are also all Democrats including Patrick Kelly (who Dr. Spiehs is running against in the upcoming November 8 election), Shannon Reid, and Shannon Portillo.

“I just got to ask you guys out there in Lawrence, what more do you need to say, ‘I think we need to make a change here,’” Dr. Spiehs said. “I get that you might not be on board. You might be turned off by the fact that I’m a Republican, but I will oppose everything that those Democrat—those communist county commissioners come up with on the board there. So, if you’re wondering why your taxes are increasing and it’s hard to make ends meet, look no further than who you continue to vote into office and think about voting for somebody different.”

Other things he made mention was the fact that the city commissioners were going to vote to make it so fewer people could speak at the meetings. He also made mention of a video by San Joaquin Valley Transparency where Lawrence City Commissioner Courtney Shipley specifically took the burn for a comment she made regarding keeping White men off the commission board and high fiving the local police for police brutality.

After a 90-day ban from speaking at the USD 497 schoolboard meetings via online connection due to speaking about superintendent Anthony Lewis’ personal business officially ended, Dr. Spiehs was finally able to speak at the USD 497 schoolboard meetings once more On Monday, September 12. He was unable to go in person as he is permanently banned from stepping on USD 497 grounds due to refusing to wearing a mask during the COVID-19 pandemic.

“Today, the schoolboard tweeted out, dare I say, misinformation about what they’re going to vote on for the budget,” Dr. Spiehs said. “They said that they were going to decrease the taxes when in reality, if you look at the numbers, the revenue neutral rate is at 48.036. When I say, ‘revenue neutral,’ that means they won’t collect a dollar more or a dollar under, they’re going for that number, and they’re proposing 52.840, and they’re actually going to vote for 51.776, so that’s an increase of nearly 3 mils. They’ve proposed a higher number, and they’re going to vote on it tonight and they’ll tell you it’s a decrease but it’s actually an increase.”

Dr. Spiehs further pointed out that the county commissioners did the same thing at their previous meeting as well when they said they’d decrease the mil levy, but actually proposed 4 higher than the net neutral before voting one under that to increase it.

According to douglascountyks.org, “The mill levy is the tax rate that is applied to the assessed value. In general terms, the mill levy is determined by dividing the dollars needed for local services by the assessed property value in the service area. An additional amount is then added for public schools. After the local government budgets are published and hearings are completed, the county clerk computes the final mill levies for each tax unit and certifies the tax roll to the county treasurer for collection.”

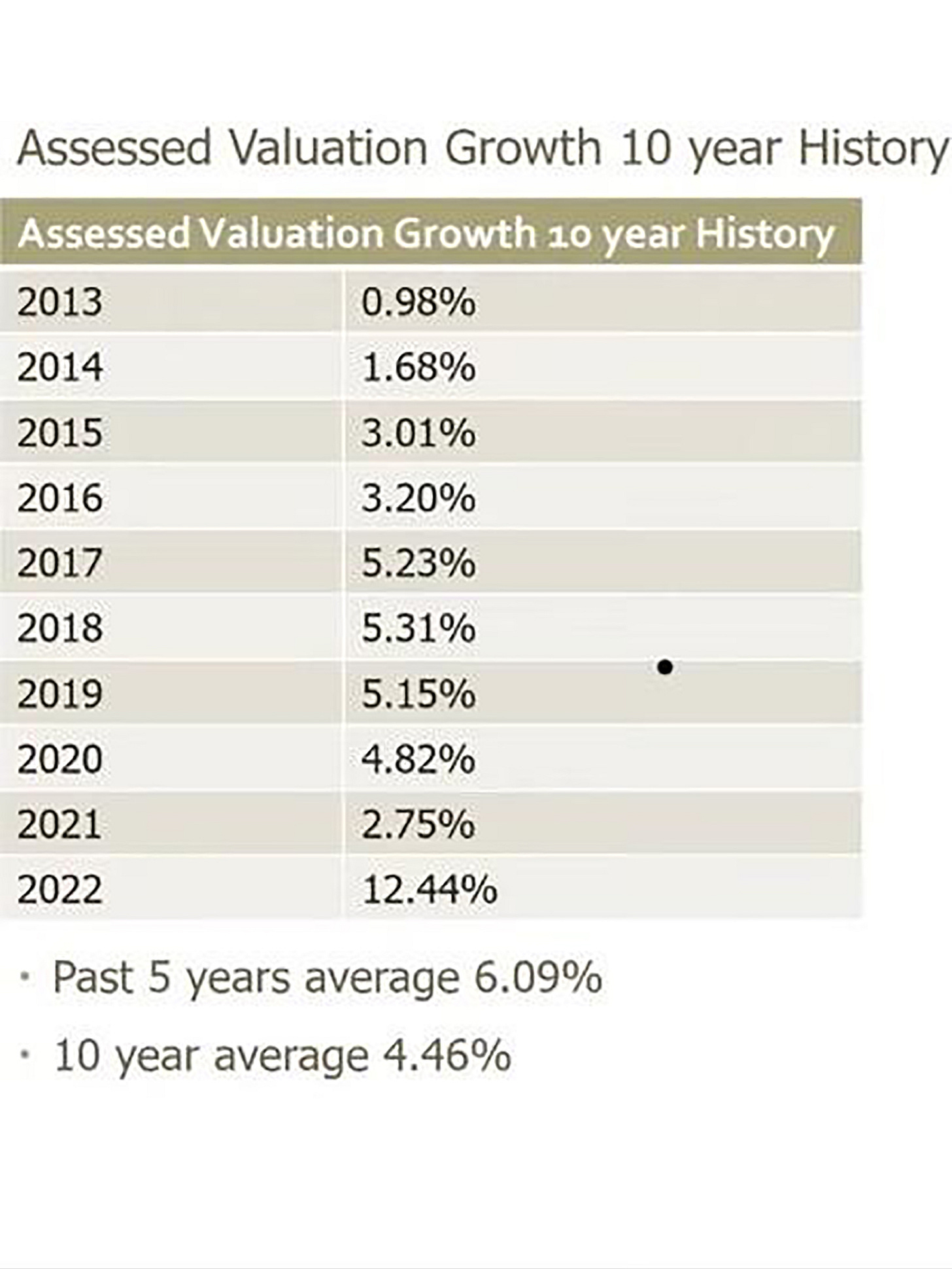

In 2022 alone, the assessed valuation growth went up 12.44 percent, nearly ten percent higher than last year. Assessed valuation is the valuation of a real estate asset to determine the property taxes applicable on it. What the local governments are doing is taxing people to the point that many can no longer live in their homes, a problem for many lower income Lawrence locals. However, this problem is not new in the city. A 2018 article by Lawrence Journal-World found that Lawrence’s homeless population increased by 32 percent from 2013 to 2018. In 2019, another article by Lawrence Journal-World showed that Lawrence’s homeless count increased by 35 percent in a single year. In 2020, Lawrence had 408 homeless people. With a population of 97,348 in 2020, that comes out to 0.42 percent of Lawrence’s population being homeless. Compare that to Wichita’s 619 homeless people in the city of 390,566 people, and we find their homeless only make up 0.16 percent of the city’s population, despite having a population four times greater than Lawrence. According to the 2022 point-in-time (PIT) summary, one in four homeless people in the state of Kansas are in Douglas County.

Dr. Spiehs sees that changes need to be made in Douglas County and would do so as a Republican who would oppose his Democrat commission members at every turn unless he sees a benefit for the county. To get his message out further, he has started a YouTube channel. He goes into how he would fix the Douglas County tax problem in one video where he talks about TABOR, a Colorado amendment approved by voters in 1992. TABOR is an acronym for Taxpayer Bill of Rights, and Dr. Spiehs said it would not be exactly like Colorado’s TABOR Amendment, but he does highlight three things he would like to see differently when it comes to increasing taxes in Douglas County:

Have the public vote on whether to raise taxes

Put a cap on tax revenue

Refund all surplus tax revenue

To watch the full video, click here. To learn more about Dr. Spiehs, check out his YouTube channel here.